The American Express Cobalt is built for Canadians who want to earn meaningful rewards from everyday purchases rather than relying on occasional travel or luxury spending. Instead of offering a traditional annual fee paid all at once, the card uses a monthly fee structure that spreads the cost throughout the year. This approach feels more predictable and often more comfortable for users who prefer consistent monthly expenses while still accessing a premium rewards ecosystem.

What truly defines the American Express Cobalt is how closely it aligns with real-life spending habits. Dining, groceries, food delivery, and digital services represent a significant portion of most household budgets. By focusing its highest earning rates on these categories, the card allows rewards to accumulate quickly without requiring users to change how they spend or track complicated bonus schedules. The result is a card that feels intuitive, powerful, and well suited for long-term everyday use.

Key Benefits of the American Express Cobalt

The American Express Cobalt is designed to maximize everyday earning potential while keeping rewards flexible. Its main benefits include:

• Very high points earning on dining and grocery purchases in Canada

• Elevated rewards on common lifestyle categories such as streaming services

• Membership Rewards points with flexible redemption options

• Monthly fee structure instead of a single annual charge

• Ability to transfer points to select airline and hotel loyalty programs

• Access to exclusive American Express offers and experiences

• Digital wallet compatibility for fast and secure payments

• Purchase and travel-related protections

These benefits make the card especially attractive to users who want strong everyday rewards without committing to a rigid or travel-only points system.

Rates and Fees Snapshot

Below is a simplified overview of the main rates and fees associated with the American Express Cobalt. Exact terms may vary depending on individual approval and account conditions.

| Category | Details |

|---|---|

| Monthly Fee | Applies |

| Approx. Annual Cost | Around $191.88 |

| Purchase Interest Rate | Standard variable rate applies |

| Cash Advance Interest Rate | Higher variable rate applies |

| Foreign Transaction Fee | Standard foreign transaction fee applies |

| Rewards Type | Membership Rewards points |

While the card carries a monthly cost, its strong earning rates can offset the fee for users whose spending aligns with its bonus categories.

How the American Express Cobalt Earns Rewards

One of the most compelling aspects of the American Express Cobalt is its aggressive rewards structure for everyday purchases. Cardholders earn Membership Rewards points based on how and where they spend, with a clear emphasis on food-related categories that most people use frequently.

Dining, groceries, and food delivery typically earn the highest point multipliers, allowing points to accumulate quickly throughout the month. Streaming services and certain transportation-related purchases also earn elevated rewards, while all other eligible purchases continue to earn base points. This structure ensures that nearly every dollar spent contributes to long-term reward accumulation.

Importantly, the earning system does not rely on rotating categories or manual activation. Points are earned automatically, making the card easy to manage and ideal for users who want strong returns without constant oversight or optimization.

Rewards Redemption and Flexibility

Membership Rewards points are widely recognized for their flexibility, and the American Express Cobalt is no exception. Once points are earned, cardholders can redeem them in several ways depending on personal preferences and financial goals.

Common redemption options include travel bookings, statement credits, gift cards, merchandise, and transfers to select airline or hotel loyalty programs. This flexibility allows users to adapt their redemption strategy over time, whether focusing on travel in one phase of life or everyday savings in another.

The ability to transfer points can significantly increase value when used strategically, but even simple redemptions provide tangible benefits. This adaptability is one of the reasons the Cobalt remains relevant for long-term cardholders.

How It Compares to Other Rewards Cards

Within the Canadian rewards card market, many products either focus heavily on travel or offer flat cash back with limited upside. The American Express Cobalt occupies a unique middle ground by delivering strong category-based earning while maintaining flexible redemption options.

Compared to basic cash back cards, the Cobalt offers higher potential value for users who spend heavily on dining and groceries. Compared to premium travel cards, it avoids high annual fees and complex benefit structures that may not suit every lifestyle. Its monthly fee model also lowers the psychological barrier of entry for users hesitant to commit to a large upfront cost.

Rather than being optimized for a single type of spender, the Cobalt adapts well to changing needs, which is a major advantage for long-term use.

Who the American Express Cobalt Is Best For

The American Express Cobalt is an excellent fit if you:

• Spend frequently on dining, groceries, and food delivery

• Want flexible points instead of fixed cash back

• Prefer earning rewards on everyday purchases

• Value multiple redemption options beyond travel

• Are comfortable with a monthly fee structure

Users who prioritize no foreign transaction fees, premium travel insurance packages, or universal card acceptance may find better alignment elsewhere. However, for everyday rewards and flexibility, the Cobalt performs exceptionally well.

Frequently Asked Questions About the American Express Cobalt

Does the American Express Cobalt have an annual fee?

The card uses a monthly fee instead of a traditional annual fee.

How are rewards earned?

Membership Rewards points are earned on eligible purchases, with higher rates on select everyday categories.

Can points be used for travel and non-travel redemptions?

Yes. Points can be redeemed for travel, statement credits, and other options.

Is this card suitable as a primary everyday card?

Yes. Many users rely on it as their main card due to its strong everyday earning potential.

Does this card work well long term?

Yes. Its flexible rewards and consistent earning structure make it suitable for extended use.

Final Takeaway: Strong Everyday Rewards With Long-Term Flexibility

The American Express Cobalt stands out by rewarding what people already spend on every day. With high earning rates on dining and groceries, flexible Membership Rewards points, and a manageable monthly cost, it delivers consistent value without unnecessary complexity.

While it does include a monthly fee and standard foreign transaction charges, its earning power often outweighs those costs for the right user. For Canadians looking to turn routine purchases into flexible rewards and maintain long-term value, the American Express Cobalt remains one of the strongest everyday rewards cards available.

Home Trust Preferred Visa: No-Fee Global Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Home Trust Preferred Visa helps you avoid annual fees and foreign transaction fees while earning cash back on everyday spending.</p>

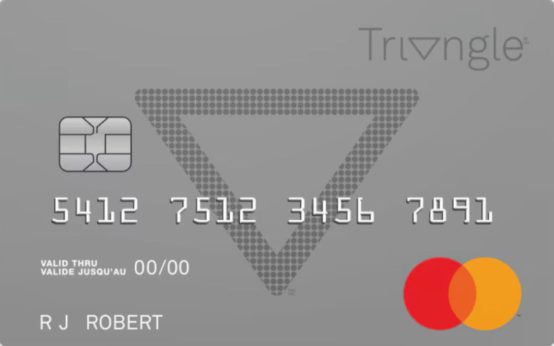

Home Trust Preferred Visa: No-Fee Global Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Home Trust Preferred Visa helps you avoid annual fees and foreign transaction fees while earning cash back on everyday spending.</p>  Triangle Mastercard: Simple Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Triangle Mastercard earns Canadian Tire Money on everyday purchases with no annual fee, delivering practical value for daily spending.</p>

Triangle Mastercard: Simple Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Triangle Mastercard earns Canadian Tire Money on everyday purchases with no annual fee, delivering practical value for daily spending.</p>  Meridian Visa Cash Back: Simple Cash Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Meridian Visa Cash Back offers straightforward cash back on everyday purchases with no annual fee, making daily spending more rewarding.</p>

Meridian Visa Cash Back: Simple Cash Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Meridian Visa Cash Back offers straightforward cash back on everyday purchases with no annual fee, making daily spending more rewarding.</p>