The Barclaycard Platinum credit card is built for people who want to regain control of their finances and reduce the cost of carrying existing credit card debt. Instead of focusing on rewards or incentives, this card is designed with one clear purpose: helping you manage balances more efficiently.

With extended balance transfer offers and a straightforward structure, the Barclaycard Platinum gives you the time and flexibility needed to focus on repayment without the constant pressure of high interest charges. It’s a solution created for practical financial decisions, not impulse spending.

If you’re looking for a card that prioritizes stability, clarity, and long-term financial improvement, the Barclaycard Platinum offers a disciplined and reliable path forward—allowing you to consolidate debt, simplify payments, and move toward a stronger financial future.

Key Benefits of the Barclaycard Platinum

- Extended Balance Transfer Offers

Transfer existing balances and benefit from a long promotional interest period, helping reduce the cost of repayment. - Lower Interest Pressure

Promotional rates give you breathing room to focus on paying down your balance rather than accumulating interest. - Purchase Rate Flexibility

Some offers may include promotional rates on purchases, adding flexibility for short-term spending needs. - Fraud Protection and Security

Includes protection against unauthorized transactions, helping keep your account secure. - Digital Account Management

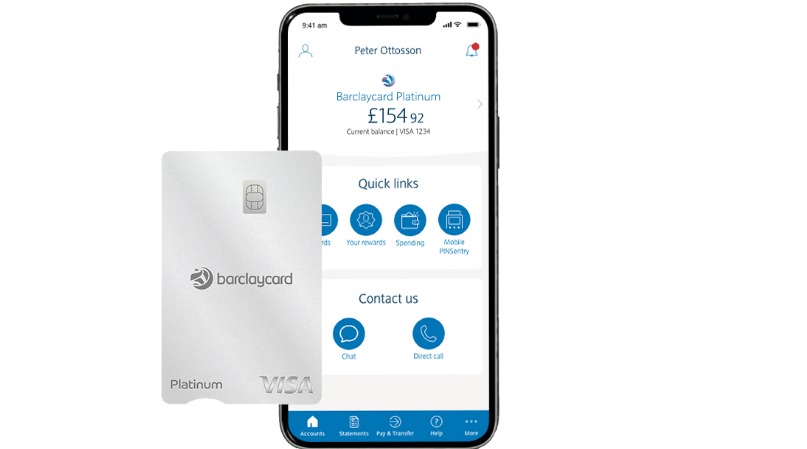

Manage balances, payments, and transactions easily through Barclaycard’s online and mobile tools. - Established Lender Support

Backed by Barclaycard’s long-standing experience in consumer credit, providing reliability and customer support.

How This Card Works — And Who It’s Best For

The Barclaycard Platinum works by allowing you to transfer balances from other credit cards and repay them over time at a reduced or promotional interest rate.

This approach helps consolidate debt into one place, making payments easier to manage and more predictable.

The card is best suited for individuals who already carry credit card balances and want to reduce interest costs while working toward becoming debt-free.

It is not designed for rewards seekers or frequent spenders—but rather for those focused on financial recovery and control.

You will be redirected.

Rates, Fees, and Key Details (At a Glance)

| Item | Details |

|---|---|

| Representative APR | 24.9% (variable) |

| Purchase Rate | 24.9% p.a. (variable) |

| Representative Credit Limit | £1,200 |

| Balance Transfer Terms | May vary based on approval |

| Approval Criteria | Depends on credit history and financial situation |

Requirements and How to Apply

Basic Requirements

- Good credit history

- Minimum age requirement (based on residency rules)

- Stable income to support repayments

Approval is based on a full credit assessment.

How to Apply

- Visit the official Barclaycard website

- Select the Barclaycard Platinum credit card

- Review the balance transfer terms and conditions

- Complete the online application

- Submit and await a decision

Many applicants receive a response quickly.

Final Thoughts: Is the Barclaycard Platinum Worth It?

If your main goal is to reduce interest, simplify repayments, and regain financial control, the Barclaycard Platinum is a strong choice.

It removes distractions, avoids unnecessary perks, and stays focused on helping you manage debt responsibly.

For anyone serious about paying down balances and moving toward a healthier financial future, the Barclaycard Platinum is a card that does exactly what it promises.

FIT Mastercard®: A Smart Start for Building Credit <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Build credit with confidence and everyday purchasing power with the FIT Mastercard®.</p>

FIT Mastercard®: A Smart Start for Building Credit <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Build credit with confidence and everyday purchasing power with the FIT Mastercard®.</p>  Wells Fargo Active Cash® Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Wells Fargo Active Cash® Card is a simple, powerful cash back card designed to deliver value every time you spend.</p>

Wells Fargo Active Cash® Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Wells Fargo Active Cash® Card is a simple, powerful cash back card designed to deliver value every time you spend.</p>  Capital One Quicksilver Credit Card: How to Apply <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>With the Capital One Quicksilver Credit Card, every purchase earns value automatically.</p>

Capital One Quicksilver Credit Card: How to Apply <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>With the Capital One Quicksilver Credit Card, every purchase earns value automatically.</p>