The Meridian Visa Cash Back is designed for Canadians who want a practical credit card that delivers consistent rewards without unnecessary complexity. Rather than focusing on premium travel perks or complicated points systems, this card emphasizes simple cash back that can be applied directly to everyday spending. With no annual fee, it removes a common barrier to long-term value and makes it easier for cardholders to benefit from their regular purchases.

What defines the Meridian Visa Cash Back is its alignment with real-world financial habits. Most people use their credit cards for groceries, fuel, dining, and recurring household expenses. This card rewards those everyday purchases in a clear and predictable way, allowing users to earn cash back without changing how they spend or tracking rotating bonus categories. The result is a card that feels reliable, easy to manage, and well suited for long-term use.

Key Benefits of the Meridian Visa Cash Back

The Meridian Visa Cash Back focuses on simplicity and everyday usability. Its main benefits include:

• No annual fee, keeping long-term ownership costs low

• Earn cash back on eligible everyday purchases

• Straightforward reward structure that is easy to understand

• Cash back can be applied directly to your statement

• No rotating categories or enrollment requirements

• Visa acceptance for broad domestic and international use

• Designed to work well as a primary everyday card

• Predictable rewards that support budgeting and planning

These benefits make the card especially appealing to users who want dependable value without ongoing management or complexity.

Rates and Fees Snapshot

Below is a general overview of common rates and fees associated with the Meridian Visa Cash Back. Exact terms may vary depending on approval and account conditions.

| Category | Details |

|---|---|

| Annual Fee | No annual fee |

| Purchase Interest Rate | Standard variable rate applies |

| Cash Advance Interest Rate | Higher variable rate applies |

| Foreign Transaction Fee | Standard foreign transaction fee applies |

| Late Payment Fee | Charged if the minimum payment is missed |

| Rewards Type | Cash back |

Although the card eliminates annual fees, carrying a balance may reduce overall value due to interest charges. Responsible use remains essential to maximize benefits.

How the Meridian Visa Cash Back Delivers Everyday Value

The strength of the Meridian Visa Cash Back lies in its consistency. Instead of offering elevated rewards only in narrow categories, the card provides cash back on everyday purchases that most users already make. This means rewards accumulate naturally over time, without the need to adjust spending behavior or chase promotional offers.

Cash back rewards are particularly appealing because of their flexibility. Unlike points that must be redeemed through specific programs or portals, cash back can be applied directly to reduce your statement balance. This makes the value immediate and easy to understand, especially for users who prioritize financial clarity.

Another advantage is the card’s low-maintenance nature. There are no rotating categories to activate, no spending thresholds to meet, and no complicated redemption charts. For users who want a card that works quietly in the background while delivering steady value, this simplicity is a major benefit.

How It Compares to Other Cash Back Cards

Within the Canadian cash back credit card market, many products attempt to attract users with high promotional rates or limited-time bonuses. While these offers can be appealing, they often require active management or higher spending levels to maintain value. The Meridian Visa Cash Back takes a different approach by prioritizing stability and ease of use.

Compared to premium cash back cards, it may offer lower earning potential in select categories, but it also avoids annual fees that can offset rewards. Compared to entry-level cards, it delivers dependable cash back without restricting how rewards can be used. This balanced positioning makes it especially suitable for users who want predictable returns without committing to premium costs.

Rather than being optimized for a specific type of spender, performs well across a wide range of everyday spending patterns.

Who the Meridian Visa Cash Back Is Best For

The Meridian Visa Cash Back is a strong option if you:

• Want a no-annual-fee credit card with simple cash back

• Prefer rewards that are easy to earn and redeem

• Use your card primarily for everyday purchases

• Value predictability over maximum reward optimization

• Want a dependable primary or secondary credit card

Users who focus heavily on travel rewards, premium insurance benefits, or high bonus categories may find stronger value in other products. However, for everyday spending and uncomplicated rewards, this card aligns well with practical financial needs.

Frequently Asked Questions About the Meridian Visa Cash Back

Does the Meridian Visa Cash Back have an annual fee?

No. The card does not charge an annual fee.

How are rewards earned?

Cash back is earned on eligible everyday purchases under a simple earning structure.

How can cash back be used?

Cash back can typically be applied directly to your statement, reducing your balance.

Is this card suitable as a main everyday card?

Yes. Many users rely on it as a primary card due to its simplicity and predictability.

Does the card include premium perks?

The card focuses on everyday cash back rather than premium travel or lifestyle benefits.

Final Takeaway: Reliable Cash Back for Everyday Spending

The Meridian Visa Cash Back delivers value by keeping things simple. With no annual fee, straightforward cash back on everyday purchases, and easy redemption, it provides a reliable way to earn rewards without added complexity.

Instead of chasing premium perks or managing intricate reward systems, this card focuses on consistency and usability. For Canadians who want a dependable credit card that quietly rewards everyday spending and supports long-term financial habits, the Meridian Visa Cash Back remains a solid and practical choice.

Home Trust Preferred Visa: No-Fee Global Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Home Trust Preferred Visa helps you avoid annual fees and foreign transaction fees while earning cash back on everyday spending.</p>

Home Trust Preferred Visa: No-Fee Global Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Home Trust Preferred Visa helps you avoid annual fees and foreign transaction fees while earning cash back on everyday spending.</p>  American Express Cobalt: Everyday Rewards Power <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>American Express Cobalt earns high Membership Rewards points on dining, groceries, and everyday spending with flexible redemption options.</p>

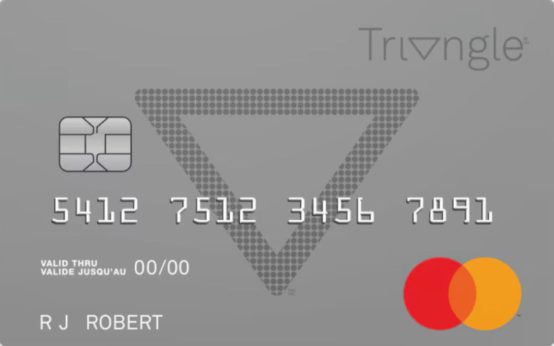

American Express Cobalt: Everyday Rewards Power <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>American Express Cobalt earns high Membership Rewards points on dining, groceries, and everyday spending with flexible redemption options.</p>  Triangle Mastercard: Simple Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Triangle Mastercard earns Canadian Tire Money on everyday purchases with no annual fee, delivering practical value for daily spending.</p>

Triangle Mastercard: Simple Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Triangle Mastercard earns Canadian Tire Money on everyday purchases with no annual fee, delivering practical value for daily spending.</p>