Elevate your financial routine with the U.S. Bank Smartly™ Visa Signature® Card — your smarter, safer, and more rewarding way to pay.

Life moves fast — and the U.S. Bank Smartly™ Visa Signature® Card keeps up. This well-rounded credit card delivers practical rewards, strong security, and everyday convenience, all without charging an annual fee.

It’s tailored for people who want efficiency without sacrificing quality. With cash-back rewards, digital account management, and Visa Signature® privileges, it’s a reliable companion for both daily purchases and long-term goals.

Benefits

1. No Annual Fee

Spend freely and earn rewards without worrying about yearly costs.

2. Reliable Cash-Back Program

Earn up to 2% cash back on eligible purchases — a simple, automatic way to make your money work harder.

3. Travel and Purchase Protections

From trip cancellation insurance to extended warranties, Visa Signature® benefits provide peace of mind wherever you go.

4. Mobile and Contactless Payments

Tap, swipe, or pay via your phone — every transaction is quick and secure.

Strengths and Consumer Benefits

What sets the Smartly™ Visa Signature® apart is its balance of usability and reliability. It fits perfectly into any lifestyle, offering steady rewards, digital tools, and top-tier protection under one program.

Savings and Advantages

The Smartly™ Card provides continuous value: no annual fees, cash rewards, and long-term savings through fraud prevention and purchase protection.

Security Features

Safety comes standard with $0 fraud liability, account alerts, and Visa Secure technology. Every transaction is protected against unauthorized use.

Eligibility Criteria

Applicants typically need good or excellent credit and must be U.S. residents over 18 years old.

Application Process

- Visit the U.S. Bank Smartly™ Card webpage.

- Click “Apply Now.”

- Enter your personal and income information.

- Submit the form for approval.

- Activate your card and start earning rewards.

Frequently Asked Questions

1. Does the card have annual fees?

No — it’s completely fee-free to own.

2. What kind of rewards can I earn?

Earn up to 2% cash back on eligible spending.

3. Does the card come with Visa Signature® perks?

Yes — including travel coverage, purchase protection, and concierge services.

4. Can I manage my card online?

Yes. Manage everything easily through the U.S. Bank mobile app or online banking.

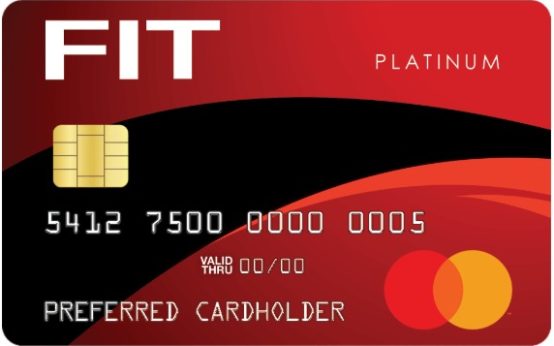

FIT Mastercard®: A Smart Start for Building Credit <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Build credit with confidence and everyday purchasing power with the FIT Mastercard®.</p>

FIT Mastercard®: A Smart Start for Building Credit <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Build credit with confidence and everyday purchasing power with the FIT Mastercard®.</p>  Wells Fargo Active Cash® Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Wells Fargo Active Cash® Card is a simple, powerful cash back card designed to deliver value every time you spend.</p>

Wells Fargo Active Cash® Card <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>The Wells Fargo Active Cash® Card is a simple, powerful cash back card designed to deliver value every time you spend.</p>  Capital One Quicksilver Credit Card: How to Apply <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>With the Capital One Quicksilver Credit Card, every purchase earns value automatically.</p>

Capital One Quicksilver Credit Card: How to Apply <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>With the Capital One Quicksilver Credit Card, every purchase earns value automatically.</p>